| Preferential tax helps David to develop business in China | |

http://english.dbw.cn

2011-07-08 09:19:53

|

|

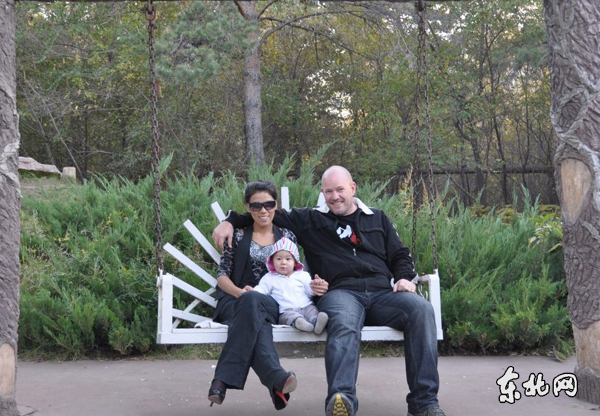

David is a 43 year old Australian that operates a foreign language school in Harbin. In the early days, David did not understand the difference between China’s tax system and foreign tax system. David said, “Many of my Chinese friends did not explain the tax system clearly, so I can only base my knowledge on the Australia tax system.” Later, a friend of his in Harbin told him which taxes needed to be payed in China and which can be tax-exempt for foreigners in China. For example, the exemption amount of Chinese residents' salary income is 2000 yuan, but David's exemption amount is 4800 yuan. David's travel allowance and visiting fee at home (twice a year) or abroad are tax-exempt. He must use legal bills to be reimbursed for his actual expenses. When David heard this news, he was so happy. He said, “China is very good. How much money I can save in China in a year? These taxes, if in my country, they must take up 1/4 of your income at least in a year.” Although at present China still gives some preferential policies to foreigners in tax breaks, David thinks it will not continue for long. He said, “I believe with China’s speed of development, the treatment of the Chinese people and foreigners will be the same. So I want to develop my career as soon as possible under the cover of this good situation. |

|

| Author: Source: dbw.cn Editor: Yang Fan |

|

中文简体

中文简体